On Monday, President Donald J. Trump announced plans to impose a 25% tariff on any nation that purchases oil or gas from Venezuela. The President stated that countries continuing such transactions would be subject to this tariff on all trade with the United States.

President Trump cited concerns over Venezuela’s actions toward the United States and alleged, without providing specific evidence, that the Venezuelan government has deliberately sent individuals involved in criminal activities, including members of the Tren de Aragua gang, into the U.S.

This announcement follows reports that the administration intends to delay previously announced tariffs, such as a 25% duty on imports of pharmaceuticals, automobiles, and lumber, which were scheduled to take effect on April 2. President Trump referred to this date as “liberation day,” indicating plans to introduce reciprocal tariffs on other nations. He emphasized that the proposed tariffs on countries importing Venezuelan oil would be implemented on the same day and would be in addition to any existing tariffs.

Despite these developments, financial markets responded positively on Monday, with major indices trading higher and showing little immediate reaction to the President’s statements.

According to the U.S. Commerce Department, Venezuela was among the top foreign suppliers of oil to the United States in 2024, with the U.S. importing approximately $5.6 billion worth of oil and gas from the country. This followed a temporary lifting of sanctions on Venezuelan oil by the previous administration in 2023, which were reinstated in April 2024 due to concerns over the Venezuelan government’s commitment to free and fair elections.

Some Venezuelan oil continues to enter the U.S. market through a joint-venture license granted to Chevron. This license, initially set to expire on April 3, has been extended to May 27 following discussions between President Trump and Chevron CEO Mike Wirth.

The administration has previously linked the revocation of such licenses to Venezuela’s reluctance to accept deported migrants, some of whom have been accused of affiliations with criminal organizations. Venezuela has recently agreed to resume repatriation flights, with 200 deportees arriving on Monday. Family members of some deportees have contested claims of criminal involvement, and the administration has provided limited evidence to substantiate these allegations.

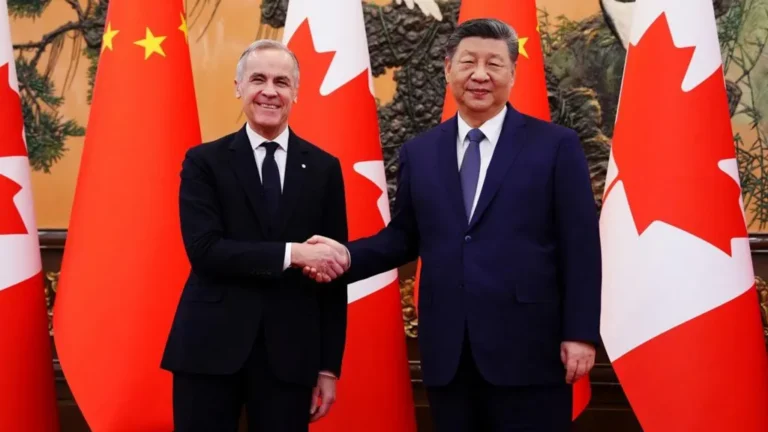

The proposed tariffs could have significant implications for countries like China, which was the largest importer of Venezuelan crude oil in 2024, receiving approximately 351,000 barrels per day. The United States was the second-largest importer, with 228,000 barrels per day. Analysts suggest that this policy may be part of a broader strategy affecting trade relations with China. Matt Smith, lead oil analyst for the Americas at Kpler, noted that the administration has already imposed a 20% tariff on all Chinese goods entering the U.S., with steel and aluminum imports facing an additional 25% tariff. If implemented, the proposed tariffs could increase duties on certain Chinese goods to 45%, and up to 70% on steel and aluminum.

The White House has not provided additional comments on the proposed tariffs at this time.