Beijing Maintains Steady Course

SHANGHAI — China left its benchmark lending rates unchanged in September for the fourth consecutive month, in line with market expectations. The People’s Bank of China (PBOC) also held its main policy rate steady last week, signaling a cautious approach to monetary easing.

The one-year Loan Prime Rate (LPR) was kept at 3.0%, while the five-year rate remained at 3.5%.

Why It Matters

The decision reflects a balancing act. On one hand, China is facing slowing domestic activity, with August factory output and retail sales posting their weakest growth since last year. On the other hand, stronger exports, a rally in Chinese equities, and easing trade tensions with the United States are reducing the pressure for immediate stimulus.

The Shanghai Composite Index is currently hovering near a 10-year high.

U.S.-China Context

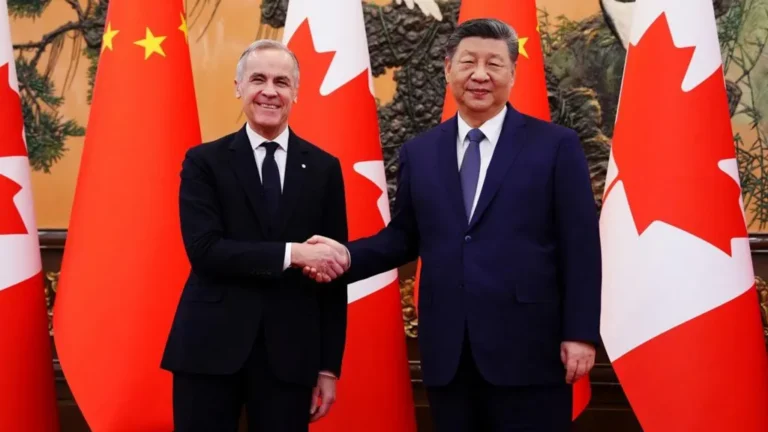

President Donald Trump said progress was made during recent negotiations with Chinese President Xi Jinping. The two leaders are expected to meet face-to-face in South Korea in six weeks to discuss trade, fentanyl, and the war in Ukraine.

The easing of trade tensions has created space for Beijing to hold rates steady rather than rushing into additional cuts.

What Analysts Expect

- Barclays: Predicts the PBOC could move later this year with a 10-basis-point rate cut and a 50-basis-point reduction in the reserve requirement ratio (RRR).

- Société Générale: Notes that the upcoming Fourth Plenum in October will be important for domestic policy, but still expects modest rate and RRR cuts before year-end.

Looking Ahead

While global central banks, including the U.S. Federal Reserve, are leaning toward monetary easing, China’s policymakers remain cautious. The PBOC appears focused on maintaining stability during a period of improving trade relations while still confronting domestic economic headwinds.

Related Coverage

- Idaho News – https://idahonews.co/idaho-news-3/

- National News – https://idahonews.co/national-news/

- Global News – https://idahonews.co/global-news/

- Economy & Market – https://idahonews.co/economy-market/