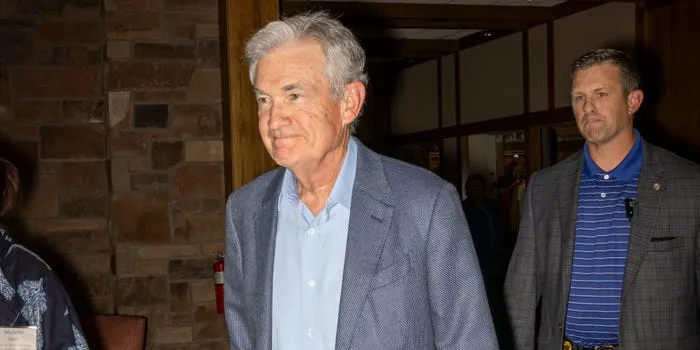

Fed Chair Avoids Broader Economic Strategy in Annual Address

Federal Reserve Chair Jerome Powell delivered a carefully worded speech at the annual Jackson Hole economic symposium, opting for a risk-averse message focused on immediate monetary policy issues. Rather than addressing the evolving structural challenges facing the U.S. economy, Powell emphasized a cautious outlook shaped by current inflation trends and labor market risks.

His remarks came at a time when the Fed faces internal division, political scrutiny, and rising economic uncertainty.

Focus on Near-Term Risks and Market Reassurance

In his speech, Powell acknowledged that downside risks to employment were increasing and that economic softening could happen quickly. He stated that the Fed’s policy stance may need adjusting depending on how the economic outlook evolves. Markets responded with enthusiasm, driving asset prices higher despite Powell’s mention of ongoing inflation concerns.

However, the Fed chair avoided deeper commentary on longer-term changes in the labor market and broader economic structure—topics that were intended to be central themes of this year’s symposium.

Monetary Policy Framework Framed as Evolution

Powell also discussed the Fed’s revised Monetary Policy Framework, characterizing the updates as an “evolution” rather than a significant shift. Critics have argued that this framing fails to account for the inadequacies of the 2020 policy revision, which included tolerance for moderate inflation overshoots—an approach that was quickly challenged by real-world events.

Despite increasing pressure for transparency and forward guidance, Powell offered little in the way of reform. He reiterated the Fed’s commitment to its 2% inflation target, without addressing how emerging structural forces like supply chain changes and global trade realignment could affect that benchmark.

Missed Opportunity to Define Strategic Vision

The narrow focus of Powell’s remarks was seen by some analysts as a missed opportunity. He did not reflect on his tenure as Fed chair, offer a roadmap for future policy direction, or discuss reforms that could strengthen the central bank’s strategic posture. His silence on issues like Fed independence and recent political controversies further underscored his tactical approach.

The Fed’s upcoming September meeting loomed large in Powell’s address, contributing to market perceptions that the central bank is prioritizing immediate signals over long-term resilience.

Broader Context: Internal Strains and External Pressures

Powell’s speech came amid growing internal disagreement within the Federal Open Market Committee (FOMC), where rare dissent from multiple board members has emerged. Simultaneously, the central bank is facing political pressure, including recent unverified claims involving a sitting board member.

In this environment, Powell avoided confrontation, signaling policy caution while postponing deeper institutional and strategic conversations for his successor.

Related Coverage

- Economy & Market – https://idahonews.co/economy-market/